Metrics suggested that investors were selling their PEPE holdings since PEPE’s popularity declined since its peak.

In addition to a decline in bullish sentiment, PEPE’s weighted sentiments shifted toward the negative.

There was a battle between bulls and bears based on market indicators.

PEPE’s social dominance also declined last week, which suggests less interest from investors. Trade volume is one indicator of investor interest.

How much does 1000 PEPE currently cost in USD?

There was little movement in memecoin prices last week

In the past 24 hours, PEPE’s price has not moved much, as seen from the chart above.

In terms of market capitalization, memecoin was ranked 69th out of 69 cryptos, according to CoinMarketCap. It was trading at $0.000001528 at the time of writing.

The sentiments chart also displayed a decline in bullish sentiment toward PEPE after it spiked. Bullish sentiment declined by 56% over the last week around PEPE.

Is PEPE again being purchased by whales?

A whale activity development was highlighted by Lookonchain, despite the sluggish memecoin price action.

It was speculated that whales accumulated the coin by withdrawing a 1.27 trillion PEPE from Binance on 18 May. This was not the case, as the ground reality was very different.

1/ We noticed that BlackRock Fund withdrew 1.27T $PEPE ($1.98M) from #Binance to 4 addresses 2 hrs ago.

And BlackRock Fund made $2.39M(10x) on $PEPE before! pic.twitter.com/WgVnCGXpnt

— Lookonchain (@lookonchain) May 18, 2023

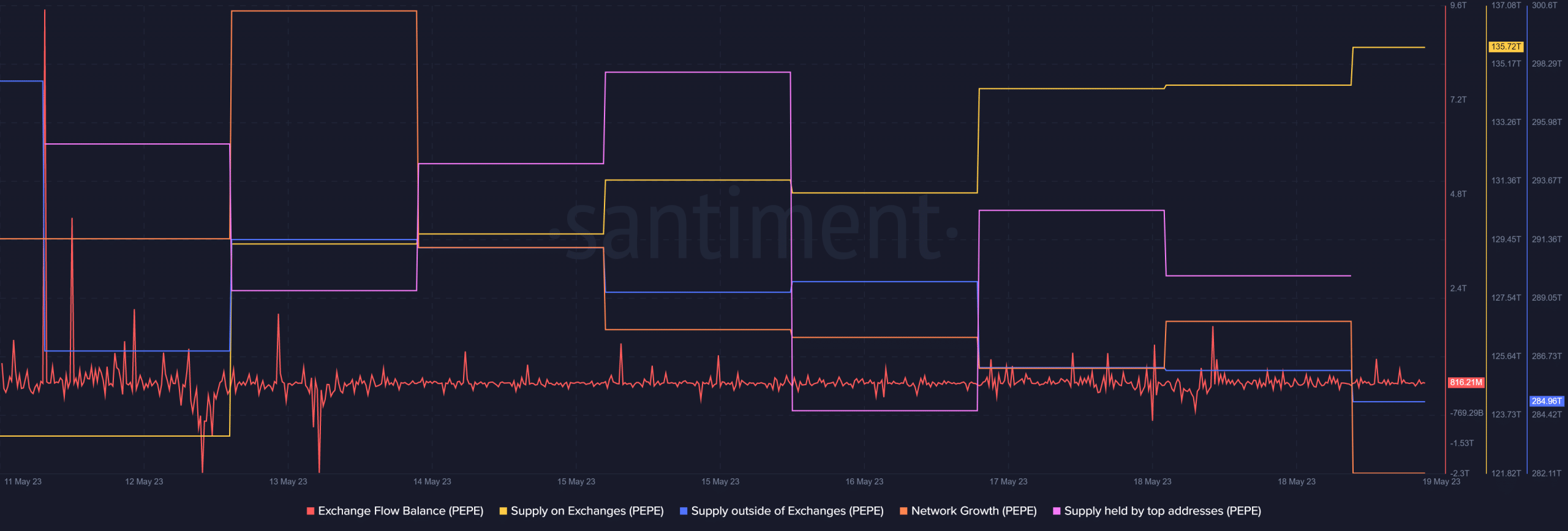

In Sentiments data, PEPE’s supply on exchanges spiked, whereas its supply outside exchanges plummeted. In addition, the supply of PEPE held by top addresses declined.

As fewer new addresses are created, the token’s network growth has also fallen. Another bearish metric is the low level of outflows from exchanges.

Here is PEPE’s price forecast for 2023

A battle between bulls and bears

The 20-day exponential moving average (EMA) and 55-day exponential moving average (EMA) were close on the cryptocurrency’s daily chart.

PEPE’s MACD also indicated a tussle, while Chaikin Money Flow (CMF) registered an uptick, suggesting a bearish outlook. The Relative Strength Index (RSI) remained well below neutral despite this.