As Ethereum’s price retests a critical resistance level, it is likely to turn overbought on shorter timeframes, resulting in sell-offs.

Ether (ETH), Ethereum’s native token, surged more than 5% on May 30 to over $1,930. However, a massive ETH inflow into an exchange is causing concern about another sell-off round for the ETH/USD pair.

Also read: The Indian government considers a ‘reverse charge’ tax on foreign crypto platforms.

In May, FTX received 58.7K Ether.

It appears that an Ether address allegedly associated with Singapore-based crypto hedge fund Three Arrow Capital sent 32,000 ETH worth $60 million to the FTX crypto exchange in an hour on May 30, on-chain data shows.

It raised suspicions that the fund would dump Ether after depositing 26,700 ETH to the same exchange in May. The primary reason is that investors transfer crypto to exchange wallets only when planning to exchange them for other assets.

dump eeth? https://t.co/7xdI80P8rZ

— Tim Copeland (@Timccopeland) May 30, 2022

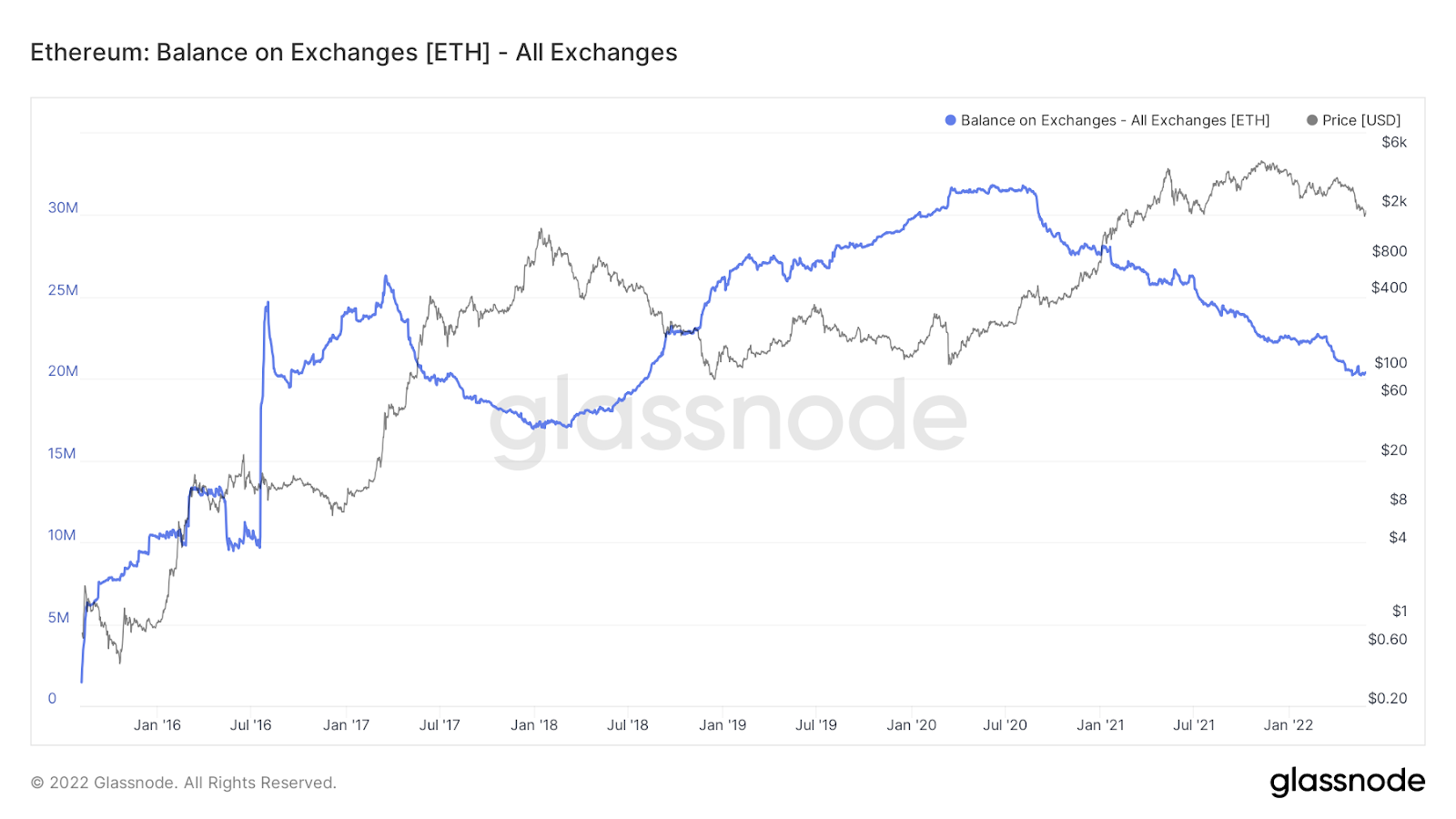

according to the on-chain data tracked by Glassnode, the number of Ethers held by exchanges continued to decline in May.

According to the MTD data, investors are holding on to their ETH investments for the long run, as shown by the drop in ETH balance across the world’s crypto exchanges month-to-date (MTD).

Strengthening of the ETH rebound

ETH is testing a crucial support-turned-resistance level near $1,920 for a breakout as Three Arrow transfers a huge Ether to FTX.

Furthermore, Ether’s relative strength index is approaching 70, which indicates over brightness in technical analysis. It is also possible that ETH could consolidate around $1,920 in the coming days before lowering back to its rising trendline support near $1,850.

Also read: After the Luna crash, is it still ok to invest in cryptos?

A solid move above the $1,920-level, accompanied by an increase in trading volumes, could set up a long-term upward trend, as illustrated below by “Wolf,” a pseudonymous market analyst.