Following a lawsuit filed by the Securities and Exchange Commission against the world’s largest cryptocurrency exchange Monday for running an illegal operation, Binance’s cryptocurrency dropped nearly 10% in one day; since regulators continue to crack down on crypto firms, Binance’s cryptocurrency dropped almost 10% in one day.

By 5 PM Monday, Binance Coin was down 9.82% to a two-month low of $275.29, down nearly 5% since the SEC announced its lawsuit. The suit follows a lawsuit filed by the federal Commodity Futures Trading Commission against the crypto exchange

earlier this year.

In the past week, BNB’s value dropped nearly 12%; since April, it has fallen more than 18%.

As Bitcoin fell over 5.5% to $25,620 on Monday, Ethereum dropped nearly 5% to $1,803. Dogecoin fell by more than 8% to just under 7 cents, and Binance was not the only crypto sinking on Monday: Bitcoin fell more than 7.1% to nearly $25,620, while Ethereum dropped almost 5% to $1,803, and Dogecoin fell more than 8% to less than $7.

A company owned by Zhao, Sigma Chain, is accused of misusing customers’ funds by Binance and its founder Changpeng Zhao. This entity engaged in ” manipulative trading ” to inflate the volume of crypto exchanges, this entity engaged in “manipulative trading.” Zhao and Binance claimed their American subsidiaries operated independently, but they controlled them behind the scenes. There is a claim that some United States customers have been allowed to use Binance’s main exchange. According to Zhao, the suit is “unjustified,” the SEC has taken several “misguided actions” against cryptocurrency.

While still up 71% yearly, Coinbase shares fell 10.5% on Monday to $57.69.

How much does 1 BNB currently cost in USD?

Despite crypto markets remaining shaky since last fall amid concerns about a crypto winter, Binance has faced several legal troubles in recent months. Chicago federal court received a complaint filed by the CFTC in March. U.S. residents are accused of benefiting from crypto futures and derivatives offered by Binance and Zhao without the CFTC’s approval.

Also alleged in the suit is that Binance’s former chief compliance officer Samuel Lim aided and abetted the company’s violations of U.S. and international laws. The company also faced scrutiny because of a backroom asset switch involving $1.8 billion between August and December 2022 without informing customers. Forbes reported in February that these customers received 100% backed tokens. As with FTX, the shifting was the culmination of internal changes. A non-binding agreement Binance had to acquire assets outside the U.S. was canceled in November.

In response to FTX’s collapse and its users’ withdrawal of billions of dollars worth of cryptocurrency, the company ceased operations, citing liquidity problems “beyond our control and ability to help.”.

Get more profit through the BNB SIP strategy

Glut in the market

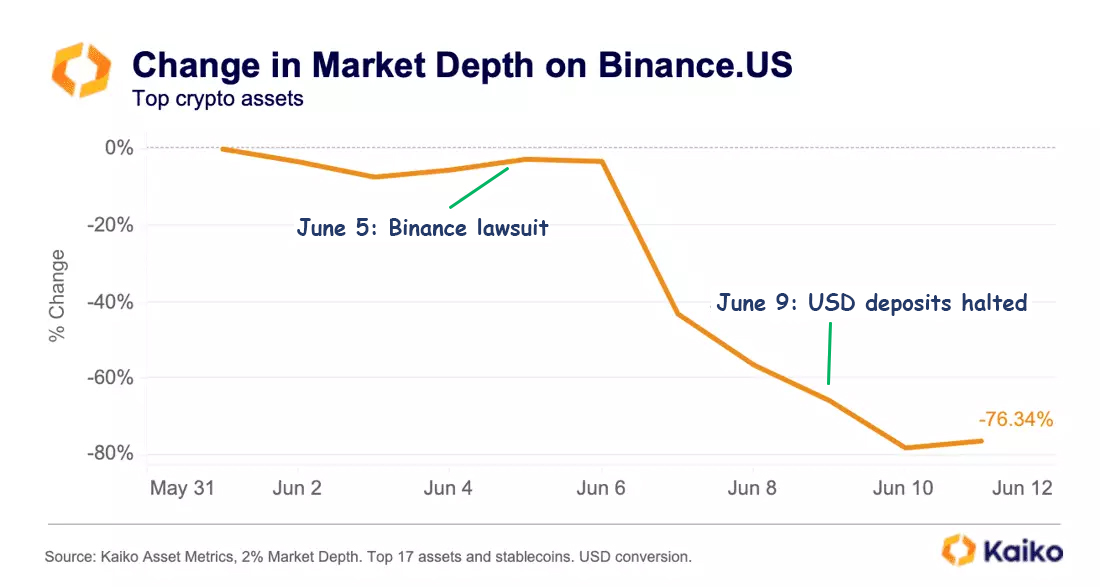

In financial markets, market depth refers to how easily an exchange can accommodate large orders without significantly affecting the security price. This indicator measures market liquidity.

Following the SEC’s announcement that U.S. assets were being frozen, market makers, who provide the most liquidity, vacated the market quickly. That infamous story repeats itself with FTX.

There was reduced liquidity on the exchange, leading to a rise in Bitcoin [BTC] prices. The price of BTC/USD on Binance.US at the time of publication was $26,316, $234 higher than that of BTC/USD on Coinbase, the largest U.S. crypto exchange.

The market share of Binance.US has declined

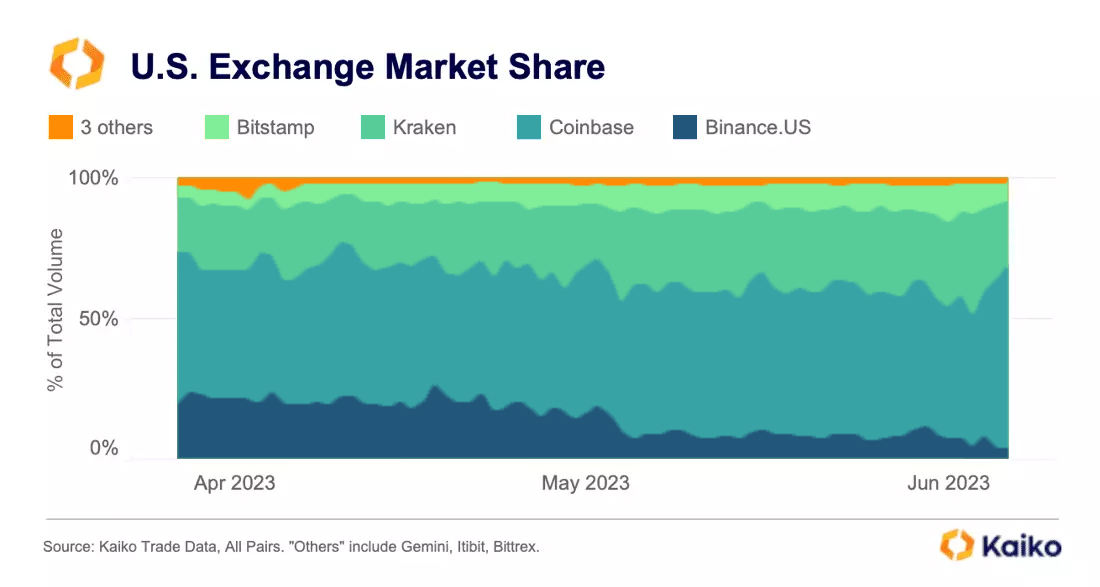

After announcing on June 13 that all USD trading on the platform would be suspended, Binance’s latest decision.US proved fatal. Investors rushed to cash out their BTC after the exchange requested they withdraw their dollars by June 13.

The platform’s trading activity also dropped sharply as a result. Compared with other U.S. trading platforms, Binance.US’s volume dropped the most. In April, the exchange had a 20% share of the pie. As of June 12, that share fell to under 5%.

Interestingly, Coinbase’s market share increased from 46% to 64% in a week, with no good reason to explain why. Due to the concentration of 80% of Kaiko’s business in the U.S. market, Kaiko’s estimates predict it will lose the most at the end of the game.

For the U.S. crypto scene to survive, Coinbase is expanding into other markets. Armstrong could move the exchange’s headquarters to the United Kingdom if the regulatory situation in the United States does not improve.

What happens if you invest just $100 in Bitcoin (BTC)?

Binance(BNB) Price Prediction for 2023

| Month | Minimum Price | Average Price | Maximum Price |

|---|---|---|---|

| Jan 2023 | $243.41 | $286.45 | $321.10 |

| Feb 2023 | $333.36 | $396.26 | $444.19 |

| Mar 2023 | $361.39 | $396.05 | $451.96 |

| Apr 2023 | $383.84 | $417.33 | $458.11/td> |

| May 2023 | $292.14 | $132.43 | $402.33 |

| Jun 2023 | $211.50 | $381.48 | $518.12 |

| Jul 2023 | $204.15 | $378.70 | $503.51 |

| Aug 2023 | $194.00 | $372.65 | $519.51 |

| Sep 2023 | $207.19 | $391.84 | $517.13 |

| Oct 2023 | $209.58 | $438.12 | $496.50 |

| Nov 2023 | $195.32 | $505.96 | $519.23 |

| Dec 2023 | $209.65 | $451.65 | $506.42 |

BNB Price Prediction – 2024, 2025, 2026, 2027, 2028, 2029, 2030

| Month | Minimum Price | Average Price | Maximum Price |

|---|---|---|---|

| 2024 | $506.41 | $565.21 | $603.32 |

| 2025 | $694.34 | $794.93 | $851.70 |

| 2026 | $904.78 | $1,072.52 | $1,082.55 |

| 2027 | $904.78 | $1,072.52 | $1,082.55 |

| 2028 | $1,118.83 | $1,257.41 | $1,290.86 |

| 2029 | $1,588.40 | $1,701.85 | $1,728.64 |

| 2030 | $2,296.33 | $2,432.19 | $2,472.51 |

Top 11 ways to make passive income with Bitcoin (BTC) in India